Support Needed by Healthcare Sector For the Sake of Carer’s Pensions

3 February 2017

Written byPhil MacKechnie

National Office

Please enter the office location/term above to receive results for your closest office as well as information matches

For people in the UK who care for a person, did you know you could get free credits toward your UK state pension? Your income, savings or investments won’t affect eligibility for carer’s credit. These credits, effectively help build up qualifying years, which count towards the entitlement for basic state pensions. Support is needed to raise awareness so that eligible UK carers get state pension carer’s credits.

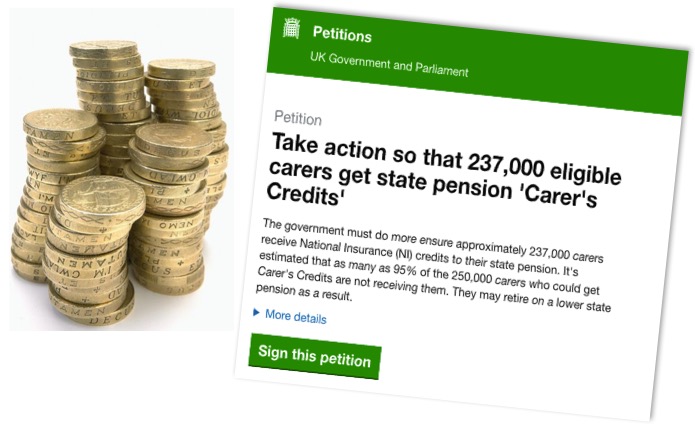

According to a recent Money Box discussion, nearly 250,000 UK carers qualify for UK Carer’s Credits, but almost all of them don’t get the credits because they don’t apply for them, which could mean they get a lower state pension than they deserve when they come to retirement age.

Sarah Pennell from SaavyWomen.co.uk says, “to qualify to get these credits the key information you need is to be caring for someone else for 20 hours a week or more”.

As an individual, you can be on another benefit also, such as disability living allowance (DLA) or attendance allowance but you don’t have to be. If a carer is working for 20 hours a week or more, and you get your care validated (e.g. from your GP, or someone from Social Services to say “Yes” you are providing them with genuine care), then you can qualify for Carers Credits.

A lot of carers are aware of carer’s allowance, which you get if you care for someone for 35 hours a week or more, however, most carers aren’t aware of carer’s credit which has a lower threshold of 20 hours a week.

Carer’s Credits are Class 3 National Insurance credits, the ones you would buy voluntarily if you did not have a full amount of National Insurance for people who reach the state pension age of 65 from April 2016, which is 35 years of contribution.

From every year of these National Insurance credits you earn or are credited with, you effectively miss out on an extra £230. This is a significant amount that people could be missing out on.

Claiming does take time unfortunately. Forms are 8 pages in length plus additional notes. Applying now depending on your age, could make for some considerable compound savings ahead of retirement, despite no one knowing what pension conditions might be in time.

Firstly, it’s important you recognise you are a carer. Often it takes individuals time to recognise this fact. Often people think they are simply doing something within the family such as caring for an elderly relative, mother or father. Also, often this starts with just being a few hours a week, and gradually it creeps up. Lastly, a carer can typically focus their attention on the person they are caring for, neglecting themselves. Even if they are getting advice for

Yes, up to 1 year.

Get in touch with your local Radfield Home Care office today and find out more about the support we offer and the difference we can make.